Toronto, ON — May 15, 2013 — (BUSINESS WIRE) — iotum, operator of the popular and versatile teleconferencing service Calliflower.com for small business, today announced it is expanding with the acquisition of California-based Global Conference Partners, provider of FreeConference.com and associated teleconferencing services.

Jason Martin, president and CEO, said iotum is acquiring all the assets of Global Conference Partners, a portfolio company of American Capital, Ltd. (NASDAQ: ACAS). In addition to FreeConference.com, the transaction includes InstantConference.com, GlobalConference.com, and several international brands. Financial terms were not disclosed.

The conferencing properties acquired from GCP will continue to be offered from Glendale, Calif.; no employees will lose their jobs as a result of the acquisition, said Martin. Calliflower also will continue as a conferencing service, he said.

“It’s a natural fit,” said Martin. “The Global Conference properties nicely complement Calliflower where we’ll quickly realize economies of scale even though all conferencing services will continue under separate brands.”

About iotum

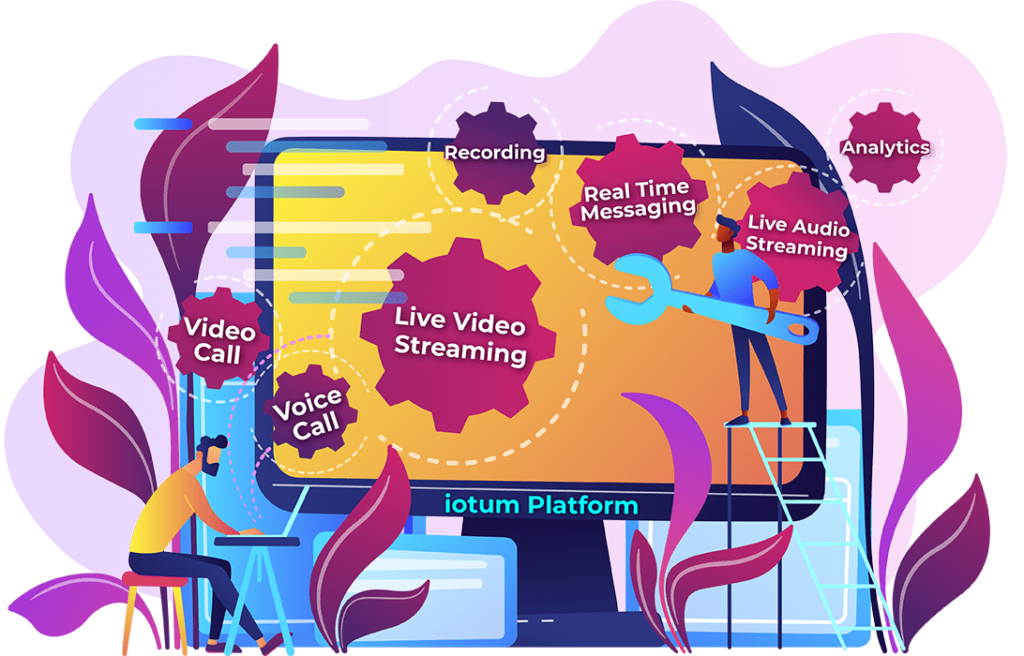

iotum is a privately-held operator of online collaboration and conference calling services. iotum created the popular Calliflower teleconference platform, which has introduced a number of innovations since its introduction in 2007, and services medium and small businesses and organizations. iotum was founded in 2006 by industry legend Alec Saunders, who joined BlackBerry as Vice President of Developer Relations in 2011. Based in Toronto, Canada, iotum’s customer base is worldwide. For further information, please visit iotum.com.

About American Capital

American Capital is a publicly traded private equity firm and global asset manager. American Capital, both directly and through its asset management business, originates, underwrites and manages investments in middle market private equity, leveraged finance, real estate and structured products. American Capital manages $21.2 billion of assets, including assets on its balance sheet and fee earning assets under management by affiliated managers, with $117 billion of total assets under management (including levered assets). Through an affiliate, American Capital manages publicly traded American Capital Agency Corp. (Nasdaq: AGNC) with approximately $13 billion market capitalization and American Capital Mortgage Investment Corp. (Nasdaq: MTGE) with approximately $1.5 billion market capitalization. From its eight offices in the U.S. and Europe, American Capital and its affiliate, European Capital, will consider investment opportunities from $10 million to $750 million. For further information, please refer to americancapital.com.